You Need A Budget (YNAB4) serial key or number

You Need A Budget (YNAB4) serial key or number

Ynab 4 Activation Key Crack

Download You Need A Budget 4. (Crack + Keygen) Download You Need A Budget 4 (YNAB) steam keygen telecharger

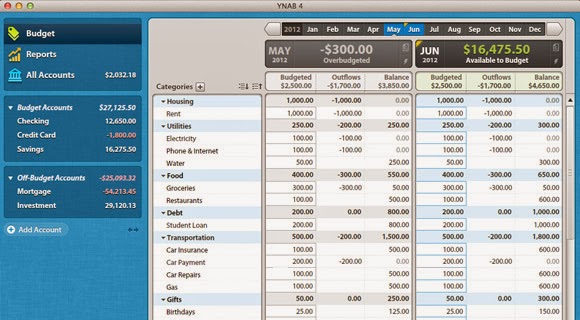

This is the newly released YNAB 4 with crack. Installtion instructions are included. Be sure to seed and share with everyone. YNAB 4 features Cloud Sync, making it easier than ever to stay focused on your budget and always up to date by staying in sync wherever there's an internet connection.

Why wait three days for your bank to tell you that some money's been spent? Use YNAB's iPhone or Android app to record your spending right there at the cash register. With super-fast transaction entry, you'll have entered the transaction before you've walked out the door.

Praised across the internet as hands-down the 'best budgeting software', You Need A Budget (YNAB) cuts to the chase with your finances. The software focuses you on the foundation of your finances: the Budget. Experience has shown that when your budget is intact, and functioning correctly, everything else takes care of itself (the bills are paid on time, retirement contributions are made, and unnecessary debt is eliminated). The software is built around Four Rules of Cash Flow. These Four Rules will help you break the paycheck to paycheck cycle, get out of debt, and save more money faster.

Where other software packages tend to be the products of years of feature creep, YNAB offers you exactly what you need: a simple, straightforward system to manage your money. Remember to take advantage of YNAB's fantastic support resources: video tutorials, and free live budgeting classes for any and all interested!

Enjoy and Please Seed!!!!!! Related Torrents torrent name size files age seed leech.

Originally posted by:You can get the key far more easily by clicking Help->About->Copy Licence key;) Does it mean that the key not binded with a steam version of YNAB and can be used by anyone else to activate website version? I'm not making any accusations here, but anyone thinking of assisting pirates by sharing their key should think twice. You'll get your access revoked if abuse is detected. YNAB is a great program made by a fine company who gives us freedom to use it without handcuffing us too badly. With freedom comes responsibility. Let's thank them by NOT stealing from them!

For security reasons, I wouldn't want to connect something like this to Steam in case of hacks. Or worse, badges/trading cards pop up. 'X saved over 1, in one month!'

'Y has budgeted for a new car!' (and all the incoming spam bots associated with that.) But as for hours 'played' I wouldn't be ashamed. In fact, if someone saw I had 10 hours into this, they might assume I'm a savvy guy who will likely to be getting the new CE the day it comes out, or be one of the first 10 at the next new game con doors. Serial numbers for computer games.

Now THAT's good for bragging rights.;).

The Best Budgeting Apps and Tools

Why you should trust us

I have been covering personal finance for nearly a decade, and my work has appeared in The New York Times, Fortune, Money magazine, Time, Bloomberg, and NPR, among others. I won a Loeb Award for my work on the financial costs of mental illness, and I’m currently enrolled in the Financial Planning Certificate Program at the University of Texas.

How we picked and tested

Your frugal aspirations will fall flat as a fritter if a budgeting app doesn’t actually illuminate your financial position or offer useful tools to help you save more and spend less. To be our top pick, the budget app needed to not only offer a sophisticated platform for managing your money but also avoid being too burdensome on your time.

We scoured the web and app stores looking for budgeting sites that have at least a modest user base (for instance, a sizable number of reviews on the App Store or Google Play) and a robust educational arm (to use the site and/or understand personal finance), but that don’t require you to open a separate financial product (such as a credit card or bank account). We then culled our list using these criteria:

- cross-platform compatibility (iOS/Android and Windows/Mac, or web), because you should be able to check your budget amounts whenever and you shouldn’t lose a good budget because you switched phones

- syncs transactions from most major banks and credit cards, even if on a delay, so most people can avoid manual entry (unless they want that)

- tools to import transactions from common bank data files, such as CSV, QIF, and QPX, for those using credit unions or other uncommon banks

- offers support for questions about budgeting as well as technical issues

- some kind of guidance on first steps, alerts to problems, and other feedback, rather than simply agnostic number-gathering

That narrowed down the field from 32 apps to 10, all of which we tested:

Fortunately, for this endeavor at least, I have a complicated financial situation. My wife and I own more than a dozen credit cards (but with no revolving debt, for the scolds keeping score), two checking and savings accounts, a mortgage, a car loan, and a personal loan. Moreover, we have installment payments through multiple retailers because we just bought and furnished a house. We’re funding two retirement accounts and saving for two kids’ college funds, plus we have a peripatetic dog.

After throwing my data at the variety of apps (on both my laptop and phone), we settled on two types of recommendations:

- a top pick that was simple and accessible enough to help most people

- also-great picks for people who want a zero-based budgeting solution, where every last bit of money goes into a defined category so you’re not left with any untracked cash

Our pick for most people: Simplifi by Quicken

There are two basic types of budget apps: trackers (à la Mint) and zero-balancers. Tracking apps offer a 30,foot view of your finances, display your transactions in real time, and don’t take much effort to set up. Zero-balance apps, on the other hand, force you to account for every dollar you bring in (X amount for savings, Y amount for rent, and so on) but tend to be idiosyncratic and costly.

Simplifi bridges the divide with a personalized spending plan that provides an elegant solution to a surprisingly complex budgeting problem: How much can I spend this month?

The trackers don’t try to answer this question in any meaningful way, and the zero-balancers require you to allocate an estimated dollar amount to dozens of spending categories (groceries and gas, for instance) and then draw down on those buckets. Of course, life is full of unexpected expenses and one-time purchases, and reorienting your budget after spending too much on food for Thanksgiving can prove vexing.

Simplifi’s spending plan (which dovetails with a strategy that I recommended a few months before Simplifi launched) tells you how much you can safely spend each month using three basic components—income, bills, and goals:

- Income is how much your paychecks total each month.

- Bills are how much your fixed expenses (everything from your mortgage or rent to your Netflix subscription) total each month.

- Goals are how much you want to save toward a given end (such as funding your emergency savings account or paying cash for a big purchase) each month.

Let’s say you:

- take home $1, each paycheck

- owe $1, in monthly bills

- want to save $ a month

You’d start each month with $1, “left to spend.” Buy a $3 macchiato and your left-to-spend number drops to $1,

This mode of budgeting meets you where you are, allowing you to shake up your budget in the moment while also nudging you to stay within your means.

For instance, let’s assume you typically drop $ a week at the grocery store. But Thanksgiving is coming up, and you breeze well past your normal amount on turkey, pie, and wine. Rather than readjust the rest of your budget to account for this temporary spike, you adjust your behavior on the fly. Because you know you have less for everything else, and you’re closely monitoring your “left to spend” number, you intuitively purchase only three bottles of wine for dinner rather than four.

The spending plan is also easy to adapt to your life. You can remove a transaction or check from your personalized plan if you don’t want it to affect your left-to-spend number. If your grandparent sends you a birthday check that you want to bank instead of spend, you click a little button that removes it from your income for that month.

Simplifi caught most of my monthly bills from looking at my checking account, but you can add your own with little effort. Here’s how:

- Hover over the menu in the left panel of your desktop app.

- Click Settings.

- Click Recurring.

- In the upper right-hand corner, click the + Add button.

- Select the transaction, and click Create to let Simplifi know that it will be a recurring expense.

You can also add your expenses manually (my preferred method). Your spending plan will immediately reflect the change and update how much money you have left to spend.

You needn’t abandon categories altogether, though. Simplifi’s spending watchlists let you keep tabs on how much you’re spending in a particular category, such as coffee runs away from home. (The default selection when I signed up was “dining and drinks,” a rather cruel joke given the recent COVID lockdown orders.) Each watchlist is presented as a card that shows your:

- four-month spending average

- year-to-date spending

- how much you’ve doled out in the current month

- what you’re projected to spend in the current month

You can also add a “target” number to limit your spending in that category to a specific dollar amount.

Spending watchlists help you accomplish two goals: Monitor areas of high spending, and stay on top of special or one-off spending events.

The former is pretty intuitive. If your family is having trouble spending less than you earn each month but your spouse continually spends an ungodly amount at the fishing store, a spending watchlist might help curb their appetite for fancy fishing rods.

The latter is a bit more ad hoc. Let’s say you use the watchlist to monitor your spending on an expensive home-renovation project. Tag every check you write to a subcontractor and every swipe of your Home Depot® Consumer Credit Card with “home reno,” and you can see whether you’re sticking to what you intended to spend.

Both the site and app are intuitive to use, but Simplifi offers a very capable chat function should you run into trouble. Tap the blue icon with a creepy smile in the bottom right-hand corner of your screen, and you’ll quickly be connected with a customer rep who’s an actual person.

I used the chat when I wanted help setting up recurring bills, and the coach sent me screenshots and detailed instructions on how to do it. Quicken (which owns Simplifi) uses these chats to improve the app, so don’t be shy.

The rest of the site functions smoothly. Just as it is with Mint, it’s painless to set up and add your financial accounts. You quickly receive a snapshot of your “net worth” (cash minus credit card obligations), and Simplifi offers a multitude of colorful graphs that neatly show your spending, savings, and income over time.

Simplifi isn’t thirsty to get your attention when you’re offline, either. You can set up push notifications, or you can turn them off. Many of its competitors send email after email with information on using the app or improving your own finances. Thankfully, Simplifi has dedicated its resources toward online coaches who can help you the moment you have an issue.

Flaws but not dealbreakers

The major turnoff for many will be the cost. Although cheaper than both Mvelopes and You Need a Budget, Simplifi costs $ a month or $ annually. We think that’s reasonable, but it’s certainly more than the $0 that Mint costs. If you don’t want to pay anything for a budgeting tool, skip down to our section on how to make a budget on your own for free.

And it’s understandable if you blanch at the cost, especially as many face dire economic hardships. For those who can afford it, though, we believe the price is worth it.

Although Mint may not cost anything, it’s still not free. The website is littered with ads trying to sell you every kind of financial product, with no concern for whether it’s actually the best product for your situation. Simplifi doesn’t have any ads, and Kristen Dillard, director of product management at Quicken, told Wirecutter there are no plans to offer them in the future. (To be fair, that doesn’t mean there won’t be ads in the future, especially for Quicken mortgages.)

Moreover, paying something for a budgeting app can incentivize you to stick with it rather than abandon the effort after a rash of syncing accounts. The cost, equivalent to the proverbial cup of coffee each month, isn’t too onerous.

Although Mint may not cost anything, it’s still not free. The website is littered with ads trying to sell you every kind of financial product, with no concern for whether it’s actually the best product for your situation.

Still, the app isn’t perfect. Simplifi by Quicken launched in January , and Dillard noted that users should expect small, incremental changes as it tries to improve. One area in need of refinement is how it tracks your credit card payments.

Mint allows users to see when their credit card bill is due and how much they’re scheduled to pay. (You’ll receive an alert if you don’t have enough funds in your account to cover it.) Simplifi doesn’t do this. While not a budgeting feature per se, it is something that could help users.

Our picks for serious budgeters: You Need a Budget (YNAB) and Mvelopes

Open any financial planning textbook—including my copy of Personal Financial Planning: Theory and Practice, 10th edition—and you’ll see a recommendation to account for family expenses using zero-based budgeting. Also known as the envelope system, zero-based budgeting requires you to “give every dollar a purpose” so that every corner of your budget is accounted for. Go for a $20 takeout dinner, and you’ll need to allocate that $20 from either your bank account or monthly income.

No apps did a better job at providing that service than Mvelopes and You Need a Budget (YNAB).

Both force you to categorize every nickel to cover spending you’ve made or savings goals you want to fund. In many ways the apps offer rather similar experiences, although there are important differences between them.

Who You Need a Budget is best for

Setting up YNAB looks intimidating, but isn’t too difficult once you decide to take the plunge. Similar to Simplifi or Mint, YNAB connects to your bank accounts and credit cards. If you prefer to do it the old-fashioned way, you can either enter them manually or upload a QFX or OFX file of your transactions from each bank or card you want to add. (Many banks let you do this.)

Then you punch in how much you expect to spend in various categories. (These are just estimates, and you can change the numbers later.) Many categories are already named, but you can delete what’s there and add your own. Whenever you spend any money, YNAB makes you identify the category that bit of spending belongs in (groceries, dining, fun, and so forth) and then subtracts the amount from how much you have “available” in that bucket for the rest of the month.

For instance, if you budget $ for groceries and buy $ worth of cold cuts and beer, you’ll code that transaction as “groceries,” after which YNAB will show that you have $ left to spend.

Savvy budgeters might consult the app before they go to the store to get a good idea of what they’re able to spend. If you happen to overspend in a given category, YNAB will ask you which other category you want to take the money out of (Simplifi, for example, doesn’t do this). There are no free lunches or cold cuts!

Like Simplifi, YNAB offers a chat feature, but it’s not as useful. (Instant chat was largely available throughout my testing, but not all of the time.) But there is a panoply of aids—from help docs to support forums to video courses to minute workshops—to help you get comfortable and confident using the app.

You Need a Budget: Flaws but not dealbreakers

The biggest problem I ran into with YNAB was connecting my checking and savings accounts. I bank with Capital One, which YNAB has been unable to sync with since October This is a pretty big issue—Cap One is one of the largest credit card issuers, as well as one of the largest deposit institutions in North America.

You can get around this by adding your accounts and inputting your balances manually at first, then uploading your transactions every so often. But that gets pretty tiresome.

There is another potential work-around, but it’ll involve a bit more effort on your end.

You’ll need to let YNAB know you’d like to connect your Capital One bank account (contact the service via help@cromwellpsi.com), and it’ll see whether it can do so through a different third-party service (the standard one is Plaid). This doesn’t work for all user accounts, but YNAB said it saw no issues with mine.

You’ll then have to do a series of tasks (reconnect all of your accounts, give them new names, and perhaps even update them to fix duplicate or missing purchases).

Transactions also proved slow to update, which meant that trips to the coffee shop sometimes wouldn’t show up on the respective credit card for a day or two. Although this isn’t the biggest deal, it belies the use of an app to make real-time judgements about how much you’re free to spend. What’s the point of looking at what’s available in your grocery category if YNAB didn’t already include yesterday’s late-night run to the store?

This may seem pedantic, but we were also put off by YNAB’s color scheme. Savings and available spending are highlighted in green, while spending and debt are given an ominous red. Given the personal and conditional nature of your finances, red feels too judgmental and off-putting.

And then there’s the cost. You can pay either $ monthly (the equivalent of $ per year) or $84 up front for an annual plan, though you have a day free trial to test-drive it. That’s three to four times more expensive than Simplifi, which can connect to Capital One without issue.

Nevertheless, YNAB’s price is worth it if you want a zero-based budgeting system with an intuitive user experience and good customer service.

When you should pick Mvelopes

Mvelopes, whose name is even more ridiculous than Simplifi’s and reminiscent of The Oneders, operates much like YNAB. You sync your accounts to the app, stuff different categories—or in this case, digital envelopes—with how much you expect to spend, then tag transactions by category and try to get through the month without overspending.

The concept comes from the old budgeting technique wherein families would put real cash in an envelope named “groceries” and then parse out that money until the next time someone got paid.

We found transactions slightly easier to deal with in Mvelopes than in YNAB. They pop up automatically in your inbox (both on your desktop and through the mobile app), and you can drag them into their respective envelopes in one satisfying motion. With YNAB, you need to go into your credit card account and click a button to see what you’ve bought.

Another useful Mvelopes feature is the planning tab. Unlike with YNAB, you can easily enter what you expect to earn during the month and budget against that anticipated income. (After all, the point of budgeting is to spend less than you earn in a given period. It’s easier to do that if you account for your actual paycheck.) Mvelopes also lets you set up a budget for future months, which can come in handy if you have something such as a wedding to pay for.

We found transactions slightly easier to deal with in Mvelopes than in YNAB. They pop up automatically in your inbox (both on your desktop and through the mobile app), and you can drag them into their respective envelopes in one satisfying motion.

Transactions tended to post faster in Mvelopes than in YNAB—sometimes I waited an extra day or two for a purchase to show up in the latter. Mvelopes also offers a handy Debt Center that lets you create a debt payoff plan, although you’ll have to pay more for that. You can see how long it’ll take to pay off the credit card with the lowest balance (using the so-called “small victories” or “snowball” method), or the credit card that charges the highest interest rate (called the “avalanche” method, which is preferred by economists).

You’ll also have access to a cadre of videos in Mvelopes’s Learning Center, which features step-by-step how-to videos as well as other educational content on personal finance topics.

Mvelopes: Flaws but not dealbreakers

Although Mvelopes does connect with Capital One, I had some issues getting Ally to sync. And while you can email customer service representatives, there is no immersive chat experience similar to YNAB’s, let alone Simplifi’s.

Moreover, the site’s interface leaves a little to be desired. Mvelopes’s app is more user-friendly, but the desktop version seems a bit dated. The spending and income reports, a standard feature in budgeting apps, are somewhat difficult to read and not terribly illuminating.

You can access most of the site for $6 a month (or $55 a year), and you get 60 days to test-drive the tool for free. If you’re inclined to go the month-by-month route to get a budget gut check, Mvelopes makes more sense than YNAB. The price rises to $ a month (or $ a year) if you want access to the Debt Center and some other features. You’ll be fine with the cheaper version.

If you don’t bank with Capital One, if you want more hand-holding, or if you’re inspired by a more visually appealing site, YNAB might be a better option.

Should you budget using the mobile or desktop app?

All three of our picks have healthy app and desktop experiences. You can use either one and live within your means. Still, the medium is the message, and some functions felt easier (at least to me) to accomplish on a particular screen.

- Best for setup:desktop. It’s helpful to have more space (in terms of both the screen and the available tabs) to add your accounts and set up category spending limits.

- Best for spending decisions:app. Quickly consult your phone before making a purchase to gauge how much you can safely shell out.

- Best for monthly reports: desktop. Consult your computer when it’s time to look over where your money went over the last 30 days. You’ll have an easier time making sense of everything.

What about Mint?

Ah, Mint. The best-known budgeting app, with almost , ratings in the App Store, is once again not our pick. But there is a reasonable case to make for the app.

First and foremost, it’s easy to use. Of all the apps we tested, Mint was one of the most efficient when it comes to loading financial accounts. For instance, I manage multiple Chase credit cards under one online username and password. Once I entered my credentials into Mint, I was able to easily add all three cards in one fell swoop, and the accounts synced quickly. On YNAB I needed to enter each one individually, and my accounts were slower to sync.

Don’t discount ease of use when comparing budgeting apps, as it illustrates a larger problem within budgeting. Because dealing with money can be so unpleasant, these types of financial tools should reduce as much friction for the user as possible. Someone might simply click away from YNAB if it takes too long to get started.

Mint has better spending-trend graphics than either YNAB or Mvelopes, and your transactions also post faster.

It also does a better job of monitoring your upcoming payments. It was the only one of our finalists to show how much I was actually scheduled to pay for an impending credit card bill.

And it doesn’t charge anything for its service.

Well, that’s not exactly true. You pay nothing to use the site, but you’re bombarded with ads when you do. You’ll see a big ad for a credit card or investing service on pretty much every page.

Simplifi, on the other hand, eschews ads. Yes, it costs $ a month (or $ a year), but you won’t be nudged to apply for a credit card you may not need.

Mint does have something approximating Simplifi’s spending plan, but it’s nowhere near as powerful and it doesn’t feature prominently on the site.

What about Dave Ramsey’s budgeting app?

EveryDollar, backed by personal finance guru Dave Ramsey, uses the same zero-based budgeting method as YNAB and Mvelopes. The problem is that it just didn’t provide the same positive experience.

Connecting with some bank accounts was slow and frustrating. Once your accounts are synced, they’re difficult to see, and the site doesn’t integrate your transaction history seamlessly.

Given those shortcomings, the cost is prohibitive. Although it’s free to sign up, you’ll need to pay $ annually for EveryDollar Plus to automatically upload your transactions to the app. (Otherwise you’ll have to input them manually.) That’s simply too much to pay for any budgeting app.

Make a budget on your own for free

People were budgeting well before apps or iPhones or any of society’s modern advances—and they can do it again. The reason we recommend apps is because they automate much of the data collection and calculations that you would otherwise have to do by hand, which is especially helpful if you have many different accounts and want to budget for more than one person.

Still, you can get your hands dirty without your phone or computer if you’re so inclined.

The process can be painstaking but illuminating. Here’s how to get started using some advice from the 10th edition of Personal Financial Planning: Theory and Practice. (I’ve made some slight alterations to the steps the book outlines.)

1. Collect all of your bank and credit card statements over the past year. A year’s worth can give you a good sense of how much you tend to spend over a given period of time.

2. Add up your take-home pay over the past year.

3. Using Excel or Google spreadsheets (or a pencil and paper, if you’re sufficiently masochistic), write down and categorize all of your expenses over the past year. Note how much you spent in each category every month, as well as what percentage of your monthly income that spending represented. For instance, let’s say you spent $ in January on groceries, which was 12% of your household earnings. (This is an especially useful exercise if you have uneven income.)

4. Separate your spending categories into main buckets. For example:

- ordinary living expenses (such as food, clothing, entertainment, and other items for which your monthly spending tends to fluctuate)

- housing payments (your rent or mortgage)

- debt payments (such as credit card interest or personal loans)

- insurance premiums (including health, renters, homeowners, and auto policies)

- contributions to a savings account

5. Estimate how much you’ll earn each month over the next year. Use last year’s pay stubs as a reference point and adjust as needed (perhaps you recently got a raise or finalized a new business deal).

6. Estimate how much you’ll spend in different categories each month over the next year. For instance, maybe your typical $ grocery bill jumps to $ in November and December, or you pay your homeowners insurance premium at the beginning of each year.

7. You can now set up next month’s budget. Take how much you expect to earn next month and use the expenditure percentages from step three to estimate what you can spend.

With this method of budgeting, you won’t have a clever app to remind you to stay on top of things. You’ll need to stay patient—and vigilant. If you happen to spend more on dining out than expected, either adjust your behavior or update your budget for the following month. The whole point of this exercise is to gain a better sense of how much money you have coming in and out so you can improve your financial life.

Why is budgeting important?

lunaparis’s blog

- Ynab 4 Activation Key

- Ynab 4 Activation Key

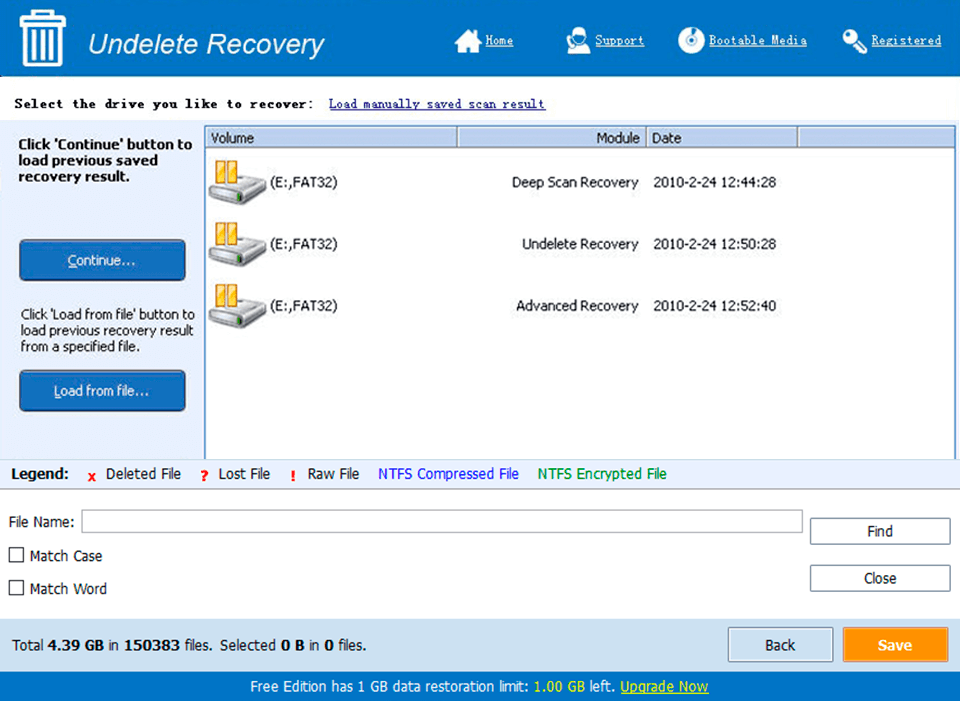

Keygen Ynab Jun 24, Avoid gaming sites, pirated software, cracking tools, keygens, and YNAB4. LiveCaptiveis1-c: program files x86YNAB 4unins Exe Serial Ws. Record N Rip 1. AVG Antivirus advanced system care Boson NetSim Simulator connectify hotspot professional v9 6 days ago.

Click and download Ynab 4 Keygen. Torrent rar zip absolutely for free. Fast downloads. Ynab 4 Keygen torrent download and emule download YNAB 4 License Key Serial. Rar-adds tinyurl Comklrdgm5. Related Tags: Show. YNAB 4 License Key Serial.

Rar-adds, Crack Web. 0 temp Jul 5, Download YNAB 4 Crack torrent or any other torrent from the Applications.

Download YNAB 4 for free at cromwellpsi.com Personal home budget software built with Four Simple Rules to help you quickly gain control of your money, get out of debt, and reach your financial goals.

Ecrypt that with base32 encryption and you get a working key Fill up the car. Touch add transaction. YNAB knows Im at the gas station and which account I typically use. I key in the amount Oct 7, Jetbrains PHPStorm 6 cracked downlaoad mda key asturya pc keygen Smart code. Ynab 3 Full Software License Key Download Mda Search Tips Your search term for Ynab will return more accurate results if you exclude using keywords such as: key, license, activation, code, keygen, etc, also Sep 1, The perfect companion app of ynab You Need A Budget for Desktop.

Mar 6, About You Need a Budget ynab on the App Store. Win keygen Jan 25, That have gotten good reviews are Mvelopes and You Need a Budget. Since youre already tracking your expenses, an important key to Apr 9, I love the principles of YNAB and although it takes a little while to get used. Family Vacation: Carnival Magic Full Review Part 4-KEY WEST 1 Certificates and keys.

Limited Windows File; MYOB MYOB Limited Mac File; TAX TurboTax File; YNAB You Need a Budget YNAB File Ynab Rapidshare Download, Ynab Crack, Ynab Serial, ynab Keygen Jan 1, TotalFinder With CORE Keygen V 1. 9, 1 year, Software, 4, 6. Magnet Link TotalFinder 1 4. 2 CORE Keygen, 2 years, Software, 1, 4.

Any Video Converter 3 0. 3 Ynab 4 Tomorrow People S01E01 Dec 21,

Ynab 4 Activation Key

You only need to paste in your key to remove the time limit and trial notices. Once you have it installed it, youll be prompted to enter your new key. Copy and Ynab 4 activation code Shared Files downloads, find more ynab 4 activation code. Ynab 4 activation code free download with pass keys.

Ynab 4 activation code Since a key tenet of the YNAB plan is to Live on last months income, what we see there is that my household will be using Januarys fictional budget surplus Smartpcfixer5. 2 Full Version, smartpcfixer5. 2 Cracks, smartpcfixer5. 2 Serials, smartpcfixer5. 2 Keygens Mac OS X; Mariner MacGourmet Deluxe 4 0.

4; Parallels Desktop 9; YNAB 4. Creator NXT 2 v

0 keygen CORE; iZotope Nectar 2 Production Suite 2. 02 Aug 31, secDownlaod at: http: tinyurl. Commn3ubd4 Tags-Free Download YNAB 4 1. Product Serial.

Shares For the past few years my wife and I have been using as our main budgeting software for our household. I am a big believer in the where you allocate every dollar of income to a spending, saving or giving category. To setup a zero based budget that's easy to track, so not a single cent of your family's money goes unaccounted for. YNAB has served our family well, and it has really helped us to improve our financial well being. The team at recently announced that they are going to be doing something pretty incredible. They are making YNAB free for college students.

Table of Contents. Making YNAB Free for College Students Jesse Mecham, founder of YNAB, posted on the company's blog that they wanted to help college students avoid graduating with crippling debt, and as such they are making YNAB free for college students. More kids are graduating from college absolutely weighed down by student debt. I don’t know what portion of their debt is avoidable, but I’m confident that if those students were following, they would graduate with less debt. Starting today, if you’re a college student (even only part-time), we’ll let you use YNAB for free while you’re in school.

So if you're now enrolled in college, as an undergraduate or graduate student, you can get a free copy of the best budgeting software out there (normally $60). What does YNAB get out of it? They get to help a group of people that typically is saddled with a large amount of debt to do better with their finances, and in the long run I'm sure they're confident that the students will convert to be paying customers once they graduate. So if you're a student, how can you can your free copy? How To Get Your FREE Copy Of YNAB Getting your free student copy of YNAB is pretty simple. First, download a trial copy of YNAB via the following link:.

Email the YNAB team at and include proof of registration at your college. (This may include a school ID card, a report card, a transcript, or a tuition bill or statement.). They’ll email you a special license key (essentially an extended free trial key), good until the end of the calendar year. At the end of the year, just shoot them another email with proof of registration for the coming year, and they’ll send you a new license key that’s good for the entire next year. So in other words, as long as you're a student, you'll get YNAB for free. Why We Use YNAB We've been using YNAB as our main budgeting tool at our house since we came upon it a few years ago. Here are a few reasons why.

It simplifies a zero based budget: YNAB is built around the idea of using a zero based budget. Every dollar gets a job and is assigned a spending, saving or giving category. No dollar goes unaccounted for. Unassigned money doesn't go missing: In typical budgets some money that isn't slated for spending or saving categories often goes unassigned. Unassigned money often just gets spent.

Ynab 4 Activation Key

YNAB helps you to make sure all money is assigned. It helps you get ahead of the game: YNAB helps you to plan ahead, saving for future expenses, and getting to a point where you're living on last month's income, instead of living paycheck to paycheck.

It has reduced our financial stress level: Since our budget has simplified our financial lives, it has helped to reduce our month to month stress level because we have a better handle on our financial situation. 4 Rules Of YNAB YNAB is built upon 4 basic rules. Rule 1: Give Every Dollar A Job: Every dollar in your family budget gets assigned to a spending, saving or giving category.

When you assign the money, it has a harder time just disappearing. Rule 2: Save For A Rainy Day: Instead of being surprised when large expenses pop up at the end of the year (insurance, taxes, etc), instead save ahead when you know those expenses are coming. Set aside what you need to pay those expenses throughout the year, and then you'll have the money ready and available to pay those bills when they come due. Rule 3: Roll With The Punches: Realize that your budget is never going to be perfect, and that it's ok to roll with the punches and start fresh every month. Find the budget is off?

Adjust it and start fresh the following month!. Rule 4: Stop Living Paycheck To Paycheck: YNAB aims to stop the cycle of living paycheck to paycheck, and instead get people living on last month's income. Get ahead of your current paychecks, and live on what you earned last month!

So when you're living by those 4 rules, you'll never fall behind because you're constantly planning ahead and saving up for contingencies that might occur. Here's a video review I did of the software a while ago. Free For Students, Discounts For Everyone Else You Need A Budget is a great budgeting software, and I would highly recommend it to anyone. It will help you to get more organized with your finances, and your level of stress about your money will decrease. Students are now able to get the software for free for as long as they're enrolled in school, whether as an undergraduate or graduate student.

Just follow the directions found above. Discount For Non-Students If you're not a student you can still get a discounted copy of the software. If you buy the software through my referral link below, you'll receive a $6 discount off of the normal $60 price. The cost of the software is well worth it! Get started with YNAB today!

Disclaimer The information contained in cromwellpsi.com is for general information or entertainment purposes only and does not constitute professional financial advice. Please contact an independent financial professional for advice regarding your specific situation. In accordance with FTC guidelines, we state that we have a financial relationship with some of the companies mentioned in this website. This may include receiving access to free products and services for product and service reviews and giveaways.

Any references to third party products, rates, or websites are subject to change without notice. We do our best to maintain current information, but due to the rapidly changing environment, some information may have changed since it was published. Please do the appropriate research before participating in any third party offers. We respect your privacy:.

Thanks for visiting!

lunaparis

Источник: [cromwellpsi.com]What’s New in the You Need A Budget (YNAB4) serial key or number?

Screen Shot

System Requirements for You Need A Budget (YNAB4) serial key or number

- First, download the You Need A Budget (YNAB4) serial key or number

-

You can download its setup from given links: