Jutoh 1.48 serial key or number

Jutoh 1.48 serial key or number

Anthemion Software Jutoh

Channel Details:

Anthemion Software Jutoh | mb

Anthemion Software Ltd. has released Jutoh - small bug fixes, plus accent-sensitive index sorting and link-to-bookmark feature in the Inspector. This software makes it easy to create ebooks in popular formats that you can sell on many ebook sites.

Auto Hide IP | MB

Camnetics Suite (Revision 13 April ) | mb

Camnetics Inc., a provider tools to engineers and designers for creating solid models of drive components, has updated Camnetics Suite , which works with Solid Edge, SolidWorks, Autodesk Inventor. This softwares provides the designer advanced tools for creating solid models of drive components and assemblies.

Coolutils Tiff Combine | Mb

Tiff Combine is a reliable utility that combines several pages into one TIFF or PDF file. It is easy-to-use. All you have to do is to setup it and make several clicks. TIFF Combine will provide you with the fast and error free combining of tiff files.

EduIQ Classroom Spy Professional | MB

Simple and effective classroom management software. Put classroom management to a higher level. This software lets you see what everyone's doing - without leaving your desk. You can monitor the activity of all student computers in your classroom remotely. Plus, you can share your screen with your students' record activity, control computers, make demos, limit the internet usage, block applications and much more.

Ekahau Site Survey (x64) ISO | Mb

Expert Wi-Fi Design and cromwellpsi.com Site Survey & Planner allows you to design and maintain Wi-Fi networks to ensure your requirements are cromwellpsi.com your WLAN for high capacity, VoIP, video streaming, or RTLS.

GridinSoft Anti-Malware Multilingual | Mb

GridinSoft Anti-Malware (formerly Trojan Killer) is an excellent anti-malware solution. It fast, effective and reliable. GridinSoft Anti-Malware has been developed specifically for automatic removal of viruses, bots, spyware, keyloggers, trojans, scareware and rootkits without the need to manually edit system files or registry. This ultimate removal tool with awesome features that leaves no chance for any sneakiest malware. GridinSoft Anti-Malware additionally fixes system modifications that were introduced by malware and which, regretfully, are often ignored by some popular antivirus scanners. The program scans ALL the files loaded at boot time for Adware, Spyware, Remote Access Trojans, Internet Worms and other malware.

HTTP Debugger Pro DC | 8 Mb

If you need to view and analyze all of the HTTP traffic between a web browser or any program that uses the HTTP protocol and the web server, then HTTP Debugger is the program for you. Web developers can view and analyze HTTP header parameter values, cookies, query strings, the source code of HTML/XML web pages and Java/VB scripts, error codes etc. They can measure the size and downloading time of their web pages and identify web site performance bottlenecks.

IAR Embedded Workbench for version | mb

IAR Systems recently released Embedded Workbench for version This release adds new and updated device support and integration possibilities as well as new features.

IP Video Transcoding Live! | Mb

IP Video Transcoding Live! (Abbreviation IPVTL) is a professional multi-channel live transcoding software designed for live media streaming over the internet, like cable and satellite TV digital video broadcasting, video surveillance and event webcasting.

Lucion FileConvert Professional Plus | Mb

FileConvert automates PDF conversion and OCR for scans, faxes, and other image files. Ideal for the paperless office, it will bulk-convert folders of old files, or watch a network scanner for new files. It's hands-free software that you can put to work and forget about. FileConvert is batch PDF conversion software for turning existing files, like scans, faxes, and Word documents into searchable PDF. It will watch for new scans from a network scanner or crawl for files to convert.

Macroplant iExplorer | Mb

iExplorer is the ultimate iPhone manager. It transfers music, messages, photos, files and everything else from any iPhone, iPod, iPad or iTunes backup to any Mac or PC computer. It's lightweight, quick to install, free to try, and up to 70x faster and more resource efficient than the competition.

Macroplant iExplorer v Final Repack | MB

iExplorer is the ultimate iPhone manager. It transfers music, messages, photos, files and everything else from any iPhone, iPod, iPad or iTunes backup to any Mac or PC computer. It's lightweight, quick to install, free to try, and up to 70x faster and more resource efficient than the competition. iExplorer lets you easily transfer music from any iPhone, iPod or iPad to a Mac or PC computer and iTunes. You can search for and preview particular songs then copy them to iTunes with the touch of a button or with drag and drop. Looking to transfer more than just a few tracks? With one click, iExplorer lets you instantly rebuild entire playlists or use the Auto Transfer feature and copy everything from your device to iTunes.

MAGIX MP3 Deluxe [ENG] [Crack] [+Update patch] | MB

MAGIX MP3 deluxe is a powerful music management software that provides you an all-in-one solution to organize your digital music collections. The program allows you to manage your digital musics, play and convert audio files, create playlists, edit audio and tags, listen to internet radio, organize songs and entire genres, transfer music to smartphone, record webradio, copy audio CD, burn music to CD/DVD and more. It is a complete solution for the management of audio files, MAGIX MP3 deluxe offers unlimited functions that are incredibly intuitive and very easy-to-use.

Windows x86/x64 / macOS or later | English | File Size: MB | MB

Elcomsoft Phone Breaker enables forensic access to password-protected backups for smartphones and portable devices based on RIM BlackBerry and Apple iOS platforms. The password recovery tool supports all Blackberry smartphones as well as Apple devices running iOS including iPhone, iPad and iPod Touch devices of all generations released to date, including the iPhone 7 Plus and iOS

ISSUER FREE WRITING PROSPECTUS Filed Pursuant to Rule Registration Statement No. Dated August 23, |

| These Step Down Trigger Autocallable Notes (the “Notes”) are senior unsecured debt securities issued by HSBC USA Inc. (“HSBC”) with returns linked to the Least Performing of the S&P ® Index and the Russell ® Index (each, an “Underlying Index” and together, the “Underlying Indices”). The Notes will rank equally with all of our other unsecured and unsubordinated debt obligations. The Notes are designed for investors who believe that the Official Closing Level of each Underlying Index will remain flat or increase moderately during the term of the Notes. If each Underlying Index closes at or above its Initial Level on any of the first four Observation Dates (annually, after one year), or if each Underlying Index closes at or above its Downside Threshold on the Final Valuation Date, HSBC will automatically call the Notes and pay you a Call Price equal to the Principal Amount per Note plus a Call Return. The Call Return, and therefore the Call Price, increases the longer the Notes are outstanding. The Underlying Index with the lowest Underlying Index Return is the “Least Performing Underlying Index.” If the Notes have not been called prior to the Final Valuation Date, then either (1) HSBC will automatically call the Notes if each Underlying Index closes at or above its Downside Threshold on the Final Valuation Date or (2) if either Underlying Index closes below the Downside Threshold of % of its Initial Level on the Final Valuation Date, HSBC will repay less than the Principal Amount, if anything, resulting in a loss that is proportionate to the decline in the Official Closing Level of the Least Performing Underlying Index from the Trade Date to the Final Valuation Date. Investing in the Notes involves significant risks. The Notes do not pay any interest. You may lose some or all of your Principal Amount. Generally, the higher the Call Return on a Note, the greater the risk of loss on that Note. The contingent repayment of principal only applies if you hold the Notes to maturity. Any payment on the Notes, including any repayment of principal, is subject to the creditworthiness of HSBC. If HSBC were to default on its payment obligations, you may not receive any amounts owed to you under the Notes and you could lose your entire investment. |

| Call Return: HSBC will automatically call the Notes for a Call Price equal to the Principal Amount plus the applicable Call Return if (i) the Official Closing Level of each Underlying Index on any of the first four Observation Dates is equal to or greater than its Initial Level or (ii) each Underlying Index closes at or above its Downside Threshold on the Final Valuation Date. The Call Return, and therefore the Call Price, increases the longer the Notes are outstanding. If the Notes are not called, investors will incur a loss at maturity. |

| Contingent Repayment of Principal Amount at Maturity: If by the Final Valuation Date, the Notes have not been called and each Underlying Index does not close below its Downside Threshold on the Final Valuation Date, HSBC will automatically call the Notes for a Call Price equal to the Principal Amount plus the applicable Call Return. However, if either Underlying Index closes below its Downside Threshold on the Final Valuation Date, HSBC will repay less than the Principal Amount, if anything, resulting in a loss that is proportionate to the decline in the Official Closing Level of the Least Performing Underlying Index from the Trade Date to the Final Valuation Date. The contingent repayment of principal only applies if you hold the Notes until maturity. Any payment on the Notes, including any repayment of principal, is subject to the creditworthiness of HSBC. |

1 Expected

2 See page 4 for additional details

The Notes are significantly riskier than conventional debt INSTRUMENTS. the terms of the Notes may not obligate HSBC TO REPAY THE FULL PRINCIPAL AMOUNT OF THE NOTES. the Notes CAN have downside MARKET risk SIMILAR TO the UNDERLYING INDICES, WHICH CAN RESULT IN A LOSS OF SOME OR ALL OF The principal amount at maturity. This MARKET risk is in addition to the CREDIT risk INHERENT IN PURCHASING a DEBT OBLIGATION OF hsbc. You should not PURCHASE the Notes if you do not understand or are not comfortable with the significant risks INVOLVED in INVESTING IN the Notes. YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED UNDER ‘‘KEY RISKS’’ BEGINNING ON PAGE 6 OF THIS FREE WRITING PROSPECTUS AND THE MORE DETAILED ‘‘RISK FACTORS’’ BEGINNING ON PAGE S-2 OF THE ACCOMPANYING EQUITY INDEX UNDERLYING SUPPLEMENT AND BEGINNING ON PAGE S-1 OF THE ACCOMPANYING PROSPECTUS SUPPLEMENT BEFORE PURCHASING ANY NOTES. EVENTS RELATING TO ANY OF THOSE RISKS, OR OTHER RISKS AND UNCERTAINTIES, COULD ADVERSELY AFFECT THE MARKET VALUE OF, AND THE RETURN ON, YOUR NOTES. |

| Note Offering |

|

| Underlying Indices | Call Return Rate | Initial Levels | Downside Threshold | CUSIP | ISIN |

The S&P ® Index (“SPX”) The Russell ® Index (“RTY”) | % to % per annum | • • | % of the applicable Initial Level | G | USG |

See “Additional Information About HSBC USA Inc. and the Notes” on page 2 of this free writing prospectus. The Notes offered will have the terms specified in the accompanying prospectus dated March 5, , the accompanying prospectus supplement dated March 5, , the accompanying Equity Index Underlying Supplement dated March 5, and the terms set forth herein.

Neither the U.S. Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of the Notes or passed upon the accuracy or the adequacy of this document, the accompanying prospectus, prospectus supplement or Equity Index Underlying Supplement. Any representation to the contrary is a criminal offense. The Notes are not deposit liabilities or other obligations of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency of the United States or any other jurisdiction.

The Notes will not be listed on any U.S. securities exchange or quotation system. HSBC Securities (USA) Inc., an affiliate of HSBC USA Inc., will purchase the Notes from HSBC USA Inc. for distribution to UBS Financial Services Inc., acting as agent. See “Supplemental Plan of Distribution (Conflicts of Interest)” on the last page of this free writing prospectus for a description of the distribution arrangements.

The Estimated Initial Value of the Notes on the Trade Date is expected to be between $ and $ per Note, which will be less than the price to public. The market value of the Notes at any time will reflect many factors and cannot be predicted with accuracy. See “Estimated Initial Value” on page 5 and “Key Risks” beginning on page 6 of this document for additional information.

| Price to Public | Underwriting Discount | Proceeds to Us | |

| Per Note | $ | $ | $ |

| Total |

The Notes:

This free writing prospectus relates to the offering of Notes identified on the cover page. As a purchaser of a Note, you will acquire a senior unsecured debt instrument linked to the least performing of the Underlying Indices, which will rank equally with all of our other unsecured and unsubordinated debt obligations. Although the offering of Notes relates to the Underlying Indices, you should not construe that fact as a recommendation of the merits of acquiring an investment linked to either Underlying Index, or as to the suitability of an investment in the Notes.

You should read this document together with the prospectus dated March 5, , the prospectus supplement dated March 5, and the Equity Index Underlying Supplement dated March 5, If the terms of the Notes offered hereby are inconsistent with those described in the accompanying Equity Index Underlying Supplement, prospectus supplement or prospectus, the terms described in this free writing prospectus shall control. You should carefully consider, among other things, the matters set forth in “Key Risks” beginning on page 5 of this free writing prospectus and in “Risk Factors” beginning on page S-2 of the Equity Index Underlying Supplement and beginning on page S-1 of the prospectus supplement, as the Notes involve risks not associated with conventional debt securities. You are urged to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes.

HSBC USA Inc. has filed a registration statement (including the Equity Index Underlying Supplement, prospectus and prospectus supplement) with the SEC for the offering to which this free writing prospectus relates. Before you invest, you should read the Equity Index Underlying Supplement, prospectus and prospectus supplement in that registration statement and other documents HSBC USA Inc. has filed with the SEC for more complete information about HSBC USA Inc. and this offering. You may get these documents for free by visiting EDGAR on the SEC’s web site at cromwellpsi.com Alternatively, HSBC Securities (USA) Inc. or any dealer participating in this offering will arrange to send you the Equity Index Underlying Supplement, prospectus and prospectus supplement if you request them by calling toll-free

You may access these documents on the SEC web site at cromwellpsi.com as follows:

| Equity Index Underlying Supplement dated March 5, |

cromwellpsi.com

| Prospectus supplement dated March 5, |

cromwellpsi.com

| Prospectus dated March 5, |

cromwellpsi.com

As used herein, references to the “Issuer,” “HSBC,” “we,” “us” and “our” are to HSBC USA Inc. References to the “prospectus supplement” mean the prospectus supplement dated March 5, , references to “accompanying prospectus” mean the HSBC USA Inc. prospectus, dated March 5, and references to the “Equity Index Underlying Supplement” mean the Equity Index Underlying Supplement dated March 5,

The Notes may be suitable for you if:

¨ You fully understand the risks inherent in an investment in the Notes, including the risk of loss of your entire initial investment.

¨ You can tolerate a loss of all or a substantial portion of your Principal Amount and are willing to make an investment that may have the same downside market risk as the Underlying Indices.

¨ You believe the Official Closing Level of each Underlying Index will not be below its Downside Threshold on the Final Valuation Date, but you are willing to lose up to % of your principal if the Notes are not called and the Official Closing Level of either Underlying Index is below its Downside Threshold on the Final Valuation Date.

¨ You understand and accept that you will not participate in any appreciation in the level of either Underlying Index and your potential return is limited to the applicable Call Return.

¨ You are willing to invest in the Notes if the Call Return Rate was set equal to the bottom of the range indicated on the cover hereof (the actual Call Return Rate will be set on the Trade Date).

¨ You believe the Underlying Indices will remain flat or appreciate moderately during the term of the Notes and the Official Closing Level of each Underlying Index will be equal to or greater than its Initial Level on at least one Observation Date, or equal to or greater than its Downside Threshold on the Final Valuation Date.

¨ You are willing to hold Notes that will be automatically called on the earliest Observation Date prior to the Final Valuation Date on which the Official Closing Level of each Underlying Index is equal to or greater than its Initial Level.

¨ You are willing to hold the Notes to maturity and do not seek an investment for which there is an active secondary market.

¨ You do understand and accept the risks associated with either Underlying Index.

¨ You are willing to accept the risk and return profile of the Notes versus a conventional debt security with a comparable maturity issued by HSBC or another issuer with a similar credit rating.

¨ You do not seek current income from your investment and are willing to forgo dividends paid on the stocks included in either Underlying Index.

¨ You are willing to assume the credit risk of HSBC, as Issuer of the Notes, and understand that if HSBC defaults on its obligations, you may not receive any amounts due to you, including any repayment of principal. | The Notes may not be suitable for you if:

¨ You do not fully understand the risks inherent in an investment in the Notes, including the risk of loss of your entire initial investment.

¨ You cannot tolerate a loss of all or a substantial portion of your Principal Amount, and you are not willing to make an investment that may have the same downside market risk as the Underlying Indices.

¨ You believe the Notes will not be called and that the Final Level of either Underlying Index will be below its Downside Threshold on the Final Valuation Date.

¨ You seek an investment that is designed to return your full Principal Amount at maturity.

¨ You seek an investment that participates in the full appreciation in the level of either Underlying Index or that has unlimited return potential.

¨ You are not willing to invest in the Notes if the Call Return Rate was set equal to the bottom of the range indicated on the cover hereof (the actual Call Return Rate will be set on the Trade Date).

¨ You are unable or unwilling to hold securities that will be automatically called on the earliest Observation Date prior to the Final Valuation Date on which the Official Closing Level of each Underlying Index is equal to or greater than its Initial Level.

¨ You are unable or unwilling to hold the Notes to maturity and seek an investment for which there will be an active secondary market.

¨ You do not understand or accept the risks associated with either Underlying Index.

¨ You prefer the lower risk, and therefore accept the potentially lower returns, of conventional debt securities with comparable maturities issued by HSBC or another issuer with a similar credit rating.

¨ You seek current income from your investment or prefer to receive the dividends paid on the stocks included in either Underlying Index.

¨ You are not willing or are unable to assume the credit risk of HSBC, as Issuer of the Notes, for any payment on the Notes, including any repayment of principal. |

The suitability considerations identified above are not exhaustive. Whether or not the Notes are a suitable investment for you will depend on your individual circumstances, and you should reach an investment decision only after you and your investment, legal, tax, accounting and other advisors have carefully considered the suitability of an investment in the Notes in light of your particular circumstances. For more information about the Underlying Indices, see page 11 of this free writing prospectus and page S of the accompanying Equity Index Underlying Supplement. You should also carefully review “Key Risks” beginning on page 5 of this free writing prospectus and “Risk Factors” beginning on page S-2 of the Equity Index Underlying Supplement and beginning on page S-1 of the prospectus supplement.

| Issuer | HSBC USA Inc. (“HSBC”) |

| Principal Amount | $10 per Note (subject to a minimum investment of $1,). |

| Term | Approximately 5 years, unless earlier called. |

| Trade Date1 | August 29, |

| Settlement Date1 | August 31, |

| Final Valuation Date1 | August 25, , subject to adjustment if a Market Disruption Event occurs, as described under “Additional Terms of the Notes — Valuation Dates” in the accompanying Equity Index Underlying Supplement. |

| Maturity Date1 | August 30, , subject to adjustment if a Market Disruption Event occurs, as described under “Additional Terms of the Notes — Coupon Payment Dates, Call Payment Dates and Maturity Date” in the accompanying Equity Index Underlying Supplement. |

| Underlying Indices | The S&P ® Index (Ticker: “SPX”) and the Russell ® Index (Ticker: “RTY”) |

| Call Feature | The Notes will be automatically called if (i) the Official Closing Level of each Underlying Index on the first, second, third or fourth Observation Date is equal to or greater than its Initial Value or (ii) the Official Closing Level of each Underlying Index on the Final Valuation Date is equal to or greater than its Downside Threshold. If the Notes are called, HSBC will pay you on the applicable Call Settlement Date a cash payment per Note equal to the Call Price for the applicable Observation Date. |

| Call Settlement Dates | With respect to the first four Observation Dates, two business days following the applicable Observation Date, unless otherwise indicated in the table below. For the Final Valuation Date, the Call Settlement Date will be the Maturity Date. |

| Call Price | The Call Price equals the Principal Amount per Note plus the applicable Call Return. |

| Call Return/Call Return Rate | The Call Return, and therefore the Call Price, increases the longer the Notes are outstanding and will be based on the Call Return Rate of % to % per annum (to be determined on the Trade Date). |

| Expected Observation Date1 | Expected Call Settlement Date1 | Hypothetical Call Return | Hypothetical Call Price (per $ Note) | |

| September 4, | September 6, | [% - %] | [$ - $] | |

| August 29, | September 3, | [% - %] | [$ - $] | |

| August 28, | September 2, | [% - %] | [$ - $] | |

| August 31, | September 2, | [% - %] | [$ - $] | |

| Final Valuation Date (August 25, ) | Maturity Date (August 30, ) | [% - %] | [$ - $] |

1 Expected. In the event HSBC makes any changes to the expected Trade Date and Settlement Date, the Final Valuation Date and Maturity Date will be changed so that the stated term of the Notes remains the same and the Observation Dates and Call Settlement Dates may be adjusted in a similar manner. The Observation Dates are subject to postponement if a Market Disruption Event occurs.

Payment at Maturity (per $10 Note)

| If the Notes have not been previously called, you will receive a payment on the Maturity Date calculated as follows: If the Final Level of the Least Performing Underlying Index is equal to or greater than its Downside Threshold on the Final Valuation Date, the Notes will automatically called and HSBC will pay you a cash payment on the Maturity Date per Note equal to the applicable Call Price.2 If the Final Level of the Least Performing Underlying Index is below its Downside Threshold on the Final Valuation Date, HSBC will pay you a cash payment on the Maturity Date that is less than the Principal Amount, equal to: $10 × (1 + Underlying Index Return of the Least Performing Underlying Index) In this case, you will incur a loss that is proportionate to the decline in the Final Level of the Least Performing Underlying Index from its Initial Level and you will lose some or all of your Principal Amount. |

| Least Performing Underlying Index | The Underlying Index with the lowest Underlying Index Return. |

| Underlying Index Return | For each Underlying Index, calculated as follows: Final Level - Initial Level |

| Initial Level | |

| Downside Threshold | For each Underlying Index, % of its Initial Level. |

| Initial Level | For each Underlying Index, its Official Closing Level on the Trade Date. |

| Final Level | For each Underlying Index, its Official Closing Level on the Final Valuation Date. |

| Official Closing Level | For each Underlying Index, its Official Closing Level on any trading day will be determined by the calculation agent based upon its closing level displayed on the page “SPX <INDEX>” or “RTY <INDEX>”, as applicable, on the Bloomberg Professional® service. If the level of an Underlying Index is not so displayed on such page, the calculation agent may refer to the display on the applicable successor page on the Bloomberg Professional® service or any successor service, as applicable. |

| Calculation Agent | HSBC USA Inc. or one of its affiliates. |

| Estimated Initial Value | The Estimated Initial Value of the Notes will be less than the price you pay to purchase the Notes. The Estimated Initial Value does not represent a minimum price at which we or any of our affiliates would be willing to purchase your Notes in the secondary market, if any, at any time. The Estimated Initial Value will be calculated on the Trade Date and will be set forth in the pricing supplement to which this free writing prospectus relates. See “Key Risks — The Estimated Initial Value of the Notes, Which Will Be Determined by Us on the Trade Date, Will Be Less Than the Price to Public and May Differ from the Market Value of the Notes in the Secondary Market, if Any.” |

2 Contingent repayment of principal is dependent on the ability of HSBC USA Inc. to satisfy its obligations when they come due.

An investment in the Notes involves significant risks. Some of the risks that apply to the Notes are summarized here. However, HSBC urges you to read the more detailed explanation of risks relating to the Notes generally in the “Risk Factors” section of the accompanying Equity Index Underlying Supplement and the accompanying prospectus supplement. HSBC also urges you to consult your investment, legal, tax, accounting and other advisors before you invest in the Notes.

| Risk of Loss at Maturity – The Notes differ from ordinary debt securities in that HSBC will not necessarily pay the full Principal Amount of the Notes. If the Notes are not called and the Final Level of one or both Underlying Indices is less than its Downside Threshold, you will lose some or all of your initial investment in an amount proportionate to the decline in the Final Level of the Least Performing Underlying Index from its Initial Level. In such a case, you will lose some or all of the principal amount of your Notes. |

| The Contingent Repayment of Principal Applies Only if You Hold the Notes to Maturity – You should be willing to hold your Notes to maturity. If you are able to sell your Notes prior to maturity in the secondary market, you may have to sell them at a loss even if the level of each Underlying Index is above its Downside Threshold. |

| The Notes Are Subject to the Credit Risk of the Issuer – The Notes are senior unsecured debt obligations of the Issuer, HSBC, and are not, either directly or indirectly, an obligation of any third party. As further described in the accompanying prospectus supplement and prospectus, the Notes will rank on par with all of the other unsecured and unsubordinated debt obligations of HSBC, except such obligations as may be preferred by operation of law. Any payment to be made on the Notes, including any repayment of principal, depends on the ability of HSBC to satisfy its obligations as they come due. As a result, the actual and perceived creditworthiness of HSBC may affect the market value of the Notes and, in the event HSBC were to default on its obligations, you may not receive any amounts owed to you under the terms of the Notes and could lose your entire investment. |

| The Estimated Initial Value of the Notes, Which Will Be Determined by Us on the Trade Date, Will Be Less Than the Price to Public and May Differ from the Market Value of the Notes in the Secondary Market, if Any – The Estimated Initial Value of the Notes will be calculated by us on the Trade Date and will be less than the price to public. The Estimated Initial Value will reflect our internal funding rate, which is the borrowing rate we pay to issue market-linked securities, as well as the mid-market value of the embedded derivatives in the Notes. This internal funding rate is typically lower than the rate we would use when we issue conventional fixed or floating rate debt securities. As a result of the difference between our internal funding rate and the rate we would use when we issue conventional fixed or floating rate debt securities, the Estimated Initial Value of the Notes may be lower if it were based on the prices at which our fixed or floating rate debt securities trade in the secondary market. In addition, if we were to use the rate we use for our conventional fixed or floating rate debt issuances, we would expect the economic terms of the Notes to be more favorable to you. We will determine the value of the embedded derivatives in the Notes by reference to our or our affiliates’ internal pricing models. These pricing models consider certain assumptions and variables, which can include volatility and interest rates. Different pricing models and assumptions could provide valuations for the Notes that are different from our Estimated Initial Value. These pricing models rely in part on certain forecasts about future events, which may prove to be incorrect. The Estimated Initial Value does not represent a minimum price at which we or any of our affiliates would be willing to purchase your Notes in the secondary market (if any exists) at any time. |

| The Price of Your Notes in the Secondary Market, if Any, Immediately After the Trade Date Will Be Less Than the Price to Public – The price to public takes into account certain costs. These costs include the underwriting discount, our affiliates’ projected hedging profits (which may or may not be realized) for assuming risks inherent in hedging our obligations under the Notes and the costs associated with structuring and hedging our obligations under the Notes. These costs, except for the underwriting discount, will be used or retained by us or one of our affiliates. If you were to sell your Notes in the secondary market, if any, the price you would receive for your Notes may be less than the price you paid for them because secondary market prices will not take into account these costs. The price of your Notes in the secondary market, if any, at any time after issuance will vary based on many factors, including the levels of the Underlying Indices and changes in market conditions, and cannot be predicted with accuracy. The Notes are not designed to be short-term trading instruments, and you should, therefore, be able and willing to hold the Notes to maturity. Any sale of the Notes prior to maturity could result in a loss to you. |

| If One of Our Affiliates Were to Repurchase Your Notes Immediately After the Settlement Date, the Price You Receive May Be Higher Than the Estimated Initial Value of the Notes – Assuming that all relevant factors remain constant after the Settlement Date, the price at which HSBC Securities (USA) Inc. may initially buy or sell the Notes in the secondary market, if any, and the value that we may initially use for customer account statements, if we provide any customer account statements at all, may exceed the Estimated Initial Value on the Trade Date for a temporary period expected to be approximately 9 months after the Settlement Date. This temporary price difference may exist because, in our discretion, we may elect to effectively reimburse to investors a portion of the estimated cost of hedging our obligations under the Notes and other costs in connection with the Notes that we will no longer expect to incur over the term of the Notes. We will make such discretionary election and determine this temporary reimbursement period on the basis of a number of factors, including the tenor of the Notes and any agreement we may have with the distributors of the Notes. The amount of our estimated costs which we effectively reimburse to investors in this way may not be allocated ratably throughout the reimbursement period, and we may discontinue such reimbursement at any time or revise the duration of the reimbursement period after the Settlement Date of the Notes based on changes in market conditions and other factors that cannot be predicted. |

| Reinvestment Risk – If your Notes are called early, the term of the Notes will be reduced and you will not receive any payment on the Notes after the applicable Call Settlement Date. There is no guarantee that you would be able to reinvest the proceeds from an automatic call of the Notes at a comparable rate of return for a similar level of risk. To the extent you are able to reinvest such proceeds in an investment comparable to the Notes, you may incur transaction costs. The Notes may be called as early as one year after issuance. |

| Higher Call Return Rates Are Generally Associated with a Greater Risk of Loss – Greater expected volatility with respect to the Underlying Indices reflects a higher expectation as of the Trade Date that, for example, the Official Closing Level of either Underlying Index could be below its Downside Threshold on the Final Valuation Date. This greater expected risk will generally be reflected in a higher Call Return Rate for that Note. However, while the Call Return Rate is a fixed amount, either Underlying Index’s volatility can change significantly over the term of the Notes. The levels of one or both Underlying Indices could fall sharply, which could result in a significant loss of principal. |

| Because the Notes Are Linked to the Performance of More Than One Underlying Index, There Is a Greater Risk of You Sustaining a Significant Loss on Your Investment — The risk that you will lose some or all of your initial investment in the Notes at maturity is greater if you invest in the Notes as opposed to substantially similar notes that are linked to the performance of only one Underlying Index. With two Underlying Indices, it is more likely that the Official Closing Level of either Underlying Index will be less than its Initial Level on an Observation Date or less than its Downside Threshold on the Final Valuation Date. Therefore it is more likely that you will suffer a significant loss on your investment at maturity. |

In addition, movements in the levels of the Underlying Indices may be correlated or uncorrelated at different times during the term of the Notes, and such correlation (or lack thereof) could have an adverse effect on your return on the Notes. The correlation of a pair of Underlying Indices represents a statistical measurement of the degree to which the ratios of the returns of those Underlying Indices were similar to each other over a given period of time.

The lower (or more negative) the correlation between two Underlying Indices, the less likely it is that those Underlying Indices will move in the same direction and, therefore, the greater the potential for one of those Underlying Indices to close below its Initial Level or Downside Threshold on an Observation Date or the Final Valuation Date, respectively. This is because the less positively correlated a pair of Underlying Indices are, the greater the likelihood that at least one of the Underlying Indices will decrease in value. This results in a greater potential for a loss of principal at maturity. However, even if two Underlying Indices have a higher positive correlation, one or both of those Underlying Indices might close below its Initial Level on an Observation Date or its Downside Threshold on the Final Valuation Date, as both of those Underlying Indices may decrease in value together.

HSBC determines the Call Return Rate for the Notes based, in part, on the correlation among the Underlying Indices, calculated using internal models at the time the terms of the Notes are set. As discussed above, increased risk resulting from lower correlation will be reflected in a higher Call Return Rate than would be payable on notes involving indices that have a higher degree of correlation.

| Your Return Will Be Based on the Individual Return of Each Underlying Index — Unlike notes linked to a basket of underlyings, the Notes will be linked to the individual performance of each Underlying Index. Because the Notes are not linked to a basket, in which case the risk is mitigated and diversified among all of the components of a basket, you will be exposed to the risk of fluctuations in the levels of the Underlying Indices to the same degree for each Underlying Index. The amount payable on the Notes, if any, depends on the performance of the Least Performing Underlying Index regardless of the performance of the other Underlying Index. You will bear the risk that either of the Underlying Indices will perform poorly. |

| Limited Return on the Notes – The return potential of the Notes is limited to the applicable Call Return regardless of the appreciation of either Underlying Index. In addition, because the Call Return, and therefore the Call Price, increases the longer the Notes have been outstanding, the Call Price payable on earlier Call Settlement Dates is less than the Call Price payable on later Call Settlement Dates. Your Notes could be called as early as the first annual Observation Date and your return would therefore be less than if the Notes were called on a later date. If the Notes are not called, you may be exposed to the decline in the level of the Least Performing Underlying Index even though you were not able to participate in any appreciation in the level of either Underlying Index. As a result, the return on an investment in the Notes could be less than the return on a hypothetical direct investment in securities represented by the Underlying Indices. |

| No Assurances of a Flat or Bullish Environment – While the Notes are structured to provide positive returns in a flat or bullish environment, we cannot assure you of the economic environment during the term or at maturity of your Notes and you may lose some or all of your investment if the Notes are not called. |

| The Notes Are Subject to Small-Capitalization Risk — The RTY tracks companies that are considered small-capitalization. These companies often have greater stock price volatility, lower trading volume and less liquidity than large-capitalization companies and therefore the level of the RTY may be more volatile than an investment in stocks issued by large-capitalization companies. Stock prices of small-capitalization companies are also more vulnerable than those of large-capitalization companies to adverse business and economic developments, and the stocks of small-capitalization companies may be thinly traded. In addition, small-capitalization companies are typically less stable financially than large-capitalization companies and may depend on a small number of key personnel, making them more vulnerable to loss of personnel. Small-capitalization companies are often subject to less analyst coverage and may be in early, and less predictable, periods of their corporate existences. Such companies tend to have smaller revenues, less diverse product lines, smaller shares of their product or service markets, fewer financial resources and less competitive strengths than large-capitalization companies and are more susceptible to adverse developments related to their products. |

| No Interest Payments – As a holder of the Notes, you will not receive interest payments. |

| Owning the Notes Is Not the Same as Owning the Stocks Included in an Underlying Index – The return on your Notes may not reflect the return you would realize if you actually owned the stocks included in an Underlying Index. As a holder of the Notes, you will not have voting rights or rights to receive dividends or other distributions or other rights that holders of the stocks included in either Underlying Index would have. Each Underlying Index is a price return index, and the Call Return excludes any cash dividend payments paid on its component stocks. |

| The Notes Are Not Insured or Guaranteed by Any Governmental Agency of the United States or Any Other Jurisdiction– The Notes are not deposit liabilities or other obligations of a bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency or program of the United States or any other jurisdiction. An investment in the Notes is subject to the credit risk of HSBC, and in the event that HSBC is unable to pay its obligations as they become due, you may not receive any amount owed to you under the Notes and could lose your entire investment. |

| Lack of Liquidity – The Notes will not be listed on any securities exchange or quotation system. One of our affiliates may offer to repurchase the Notes in the secondary market but is not required to do so and may cease any such market-making activities at any time without notice. Because other dealers are not likely to make a secondary market for the Notes, the price at which you may be able to trade your Notes is likely to depend on the price, if any, at which one of our affiliates is willing to buy the Notes. This price, if any, will exclude any fees or commissions paid when the Notes were purchased and therefore will generally be lower than such purchase price. |

| Changes Affecting an Underlying Index – The policies of an Underlying Index’s sponsor concerning additions, deletions and substitutions of the stocks included in that Underlying Index and the manner in which the sponsor takes account of certain changes affecting those stocks may adversely affect the level of that Underlying Index. The policies of the sponsors with respect to the calculation of each Underlying Index could also adversely affect the level of that Underlying Index. The sponsor may discontinue or suspend calculation or dissemination of the relevant Underlying Index. Any such actions could have an adverse effect on the value of the Notes. |

| Potential Conflicts of Interest – HSBC, UBS Financial Services Inc., or any of our or their respective affiliates may engage in business with the issuers of the stocks included in an Underlying Index, which could affect the price of such stocks or the level of that Underlying Index and thus, may present a conflict between the obligations of HSBC and you, as a holder of the Notes. The Calculation Agent, which may be HSBC or any of its affiliates, will determine the Payment at Maturity or the payment on a Call Settlement Date based on observed levels of each Underlying Index in the market. The Calculation Agent can postpone the determination of each Official Closing Level on an Observation Date and the corresponding Call Settlement Date if a Market Disruption Event exists on that Observation Date. Furthermore, the Calculation Agent can postpone the determination of each Final Level and the Maturity Date if a Market Disruption Event occurs and is continuing on the Final Valuation Date. |

| Potentially Inconsistent Research, Opinions or Recommendations by HSBC, UBS Financial Services Inc. or Their Respective Affiliates – HSBC, UBS Financial Services Inc., or any of our or their respective affiliates may publish research, express opinions or provide recommendations that are inconsistent with investing in or holding the Notes and such research, opinions or recommendations may be revised at any time. Any such research, opinions or recommendations could affect the price of the stocks included in the Underlying Indices or the levels of the Underlying Indices, and therefore, the market value of the Notes. |

| Market Price Prior to Maturity – The market price of the Notes will be influenced by many unpredictable and interrelated factors, including the levels of the Underlying Indices; the volatility of the Underlying Indices; the dividends paid on the securities included in the Underlying Indices; the time remaining to the maturity of the Notes; interest rates; geopolitical conditions and economic, financial, political and regulatory or judicial events; and the creditworthiness of HSBC. |

| Potential HSBC and UBS Financial Services Inc. Impact on Price – Trading or transactions by HSBC USA Inc., UBS Financial Services Inc., or any of our or their respective affiliates in the stocks included in the Underlying Indices, or in futures, options, exchange-traded funds or other derivative products on those stocks or relating to the Underlying Indices, may adversely affect the levels of the Underlying Indices, and, therefore, the market value of the Notes. |

| Uncertain Tax Treatment– Significant aspects of the tax treatment of the Notes are uncertain. You should consult your tax advisor about your own tax situation. See the discussion under “What Are the Tax Consequences of the Notes?” on page 10 of this free writing prospectus and the discussion under “U.S. Federal Income Tax Considerations” in the accompanying prospectus supplement. |

The scenario analysis and examples below are hypothetical and provided for illustrative purposes only. The hypothetical terms used below are not the actual terms that will apply to the Notes, which are indicated on the cover hereof. They do not purport to be representative of every possible scenario concerning increases or decreases in the level of either Underlying Index relative to its Initial Level. We cannot predict the Final Level or the Official Closing Level of either Underlying Index on any Observation Date. You should not take the scenario analysis and these examples as an indication or assurance of the expected performance of either Underlying Index. The numbers appearing in the examples below have been rounded for ease of analysis. The following scenario analysis and examples illustrate the payment at maturity or upon an automatic call per $ Note on a hypothetical offering of the Notes, based on the following assumptions (the actual Initial Level of each Underlying Index and the Call Return Rate for the Notes will be determined on the Trade Date):

Anthemion Jutoh With Keygen Download [Latest]

Anthemion Jutoh Keygen Free Download makes it easy to create e-books infamous formats that you could sell on many e-book websites. Create your venture in seconds from present files the use of the brand-new assignment wizard, or create your book from scratch the use of the integrated styled textual content editor. Pick an e-book cowl layout from Anthemion Jutoh Serial key template, or create your own cowl design with the integrated cowl editor.

You Also Like This Software !!!! C-Cleaner Professional With KeyMaker [Latest]

Anthemion Jutoh Full Version Crack Features

- Rapid to import your present content, whether in textual content, HTML, or OpenDocument.

- Speedy to create your Epub, Mobipocket, or another layout.

- Fast to edit content and switch among variations of your e-books.

jutoh is written in c++ so runs at pinnacle pace &#; no frustrating delays. - Anthemion Jutoh Crack Free Download runs on home windows, Mac, Linux, and diverse different Unix-based structures, and you could effortlessly replica your documents among machines of different types. One license can be used on multiple running structures concurrently; and rest confident that if you buy a distinctive form of desktop or laptop, you don&#;t must depart your way of running in the back of and buy the new software program.

- Way to Anthemion-Jutoh Portable configurations, you may describe variations among versions of your e-book &#; a specific cowl, an exceptional title web page, exclusive formatting &#; all without needing separate projects. Simply pick a specific configuration and click on assemble. That is precious when you are distributing e-books the use of unique websites with slightly specific necessities.

- Jutoh Download Full Version Crack installs adobe&#;s Epubcheck and Epubpreflight checker applications so that you can easily take a look at your epub e-book for inner mistakes or issues that could stand up with particular readers. The checkers are run within Anthemion Jutoh Keygen so that you do not must mess approximately with invoking the programs yourself.

- Anthemion Jutoh Portable Download lets you keep textual content, photograph, and net notes together with the e-book content. So if you&#;re writing or modifying your e-book inside Anthemion Jutoh Crack Download, you could without difficulty seek advice from your notes or store textual content that doesn&#;t but has an area.

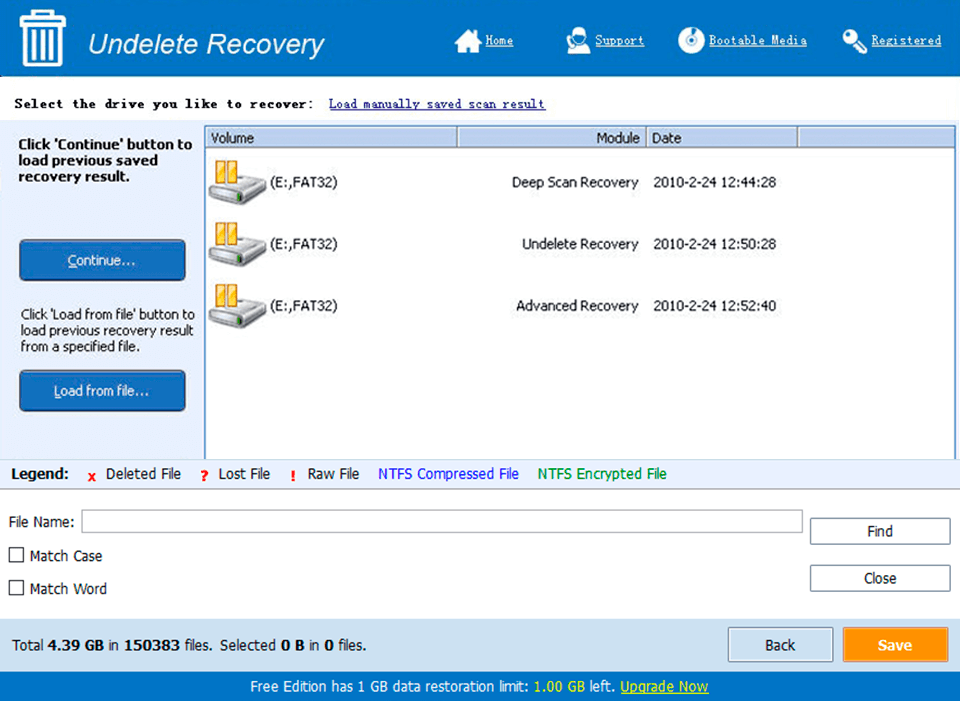

How To Install & Registered Anthemion Jutoh Keygen [Latest]

- First Download Anthemion Jutoh Portable [Latest]

- After the Download Extract the zip file using WinRAR or WinZip

- After the Extract, the zip file Installs the Program As Normal.

- After Install Don&#;t Run the Software.

- Please Always Read the Readme File.

- Please, Run the Keygen & Get the Key.

- After Install Run the Software.

- You are Done it. Now Enjoy the Full Version.

- Please share it. Sharing is Always Caring!

1 Mirror2 Mirror

You Also Like This Software !!!!Wondershare Filmora With Crack [Latest]

Download Mirror Link !!!!

Password:cromwellpsi.com

[php snippet=1]cromwellpsi.com_Anthemion Jutoh rar[php snippet=2]

What’s New in the Jutoh 1.48 serial key or number?

Screen Shot

System Requirements for Jutoh 1.48 serial key or number

- First, download the Jutoh 1.48 serial key or number

-

You can download its setup from given links: