126 Pet Wide Area Network 5.1.8 serial key or number

126 Pet Wide Area Network 5.1.8 serial key or number

If you are not the author of this article and you wish to reproduce material from it in a third party non-RSC publication you must formally request permission using Copyright Clearance Center. Go to our Instructions for using Copyright Clearance Center page for details.

Authors contributing to RSC publications (journal articles, books or book chapters) do not need to formally request permission to reproduce material contained in this article provided that the correct acknowledgement is given with the reproduced material.

Reproduced material should be attributed as follows:

- For reproduction of material from NJC:

Reproduced from Ref. XX with permission from the Centre National de la Recherche Scientifique (CNRS) and The Royal Society of Chemistry. - For reproduction of material from PCCP:

Reproduced from Ref. XX with permission from the PCCP Owner Societies. - For reproduction of material from PPS:

Reproduced from Ref. XX with permission from the European Society for Photobiology, the European Photochemistry Association, and The Royal Society of Chemistry. - For reproduction of material from all other RSC journals and books:

Reproduced from Ref. XX with permission from The Royal Society of Chemistry.

If the material has been adapted instead of reproduced from the original RSC publication "Reproduced from" can be substituted with "Adapted from".

In all cases the Ref. XX is the XXth reference in the list of references.

If you are the author of this article you do not need to formally request permission to reproduce figures, diagrams etc. contained in this article in third party publications or in a thesis or dissertation provided that the correct acknowledgement is given with the reproduced material.

Reproduced material should be attributed as follows:

- For reproduction of material from NJC:

[Original citation] - Reproduced by permission of The Royal Society of Chemistry (RSC) on behalf of the Centre National de la Recherche Scientifique (CNRS) and the RSC - For reproduction of material from PCCP:

[Original citation] - Reproduced by permission of the PCCP Owner Societies - For reproduction of material from PPS:

[Original citation] - Reproduced by permission of The Royal Society of Chemistry (RSC) on behalf of the European Society for Photobiology, the European Photochemistry Association, and RSC - For reproduction of material from all other RSC journals:

[Original citation] - Reproduced by permission of The Royal Society of Chemistry

If you are the author of this article you still need to obtain permission to reproduce the whole article in a third party publication with the exception of reproduction of the whole article in a thesis or dissertation.

Information about reproducing material from RSC articles with different licences is available on our Permission Requests page.

Table of Contents

Exhibit 15 (b)

Annual Report to shareholders for

See attachment.

Note: The Annual Report to Shareholders for is furnished hereby as an exhibit to the Securities and Exchange Commission for information only. The Annual Report to Shareholders is not filed except for such specific portions that are expressly incorporated by reference in this Report on Form F.

Table of Contents

Annual Report

Financial, social and environmental performance

simply

making a

difference

IFRS basis of presentation

The financial information included in this document is based on IFRS, unless otherwise indicated.

Forward-looking statements and other information

Please refer to chapter 20, Forward-looking statements and other information, of this Annual Report for more information about forward-looking statements, third-party market share data, fair value information, IFRS basis of preparation, use of non-GAAP information, statutory financial statements and management report, and reclassifications.

Dutch Financial Markets Supervision Act

This document comprises regulated information within the meaning of the Dutch Financial Markets Supervision Act (Wet op het Financieel Toezicht).

Statutory financial statements and management report

The chapters Group financial statements and Company financial statements contain the statutory financial statements of the Company. The introduction to the chapter Group financial statements sets out which parts of this Annual Report form the Management report within the meaning of Section of the Dutch Civil Code (and related Decrees).

2 Annual Report

Table of Contents

Annual Report 3

Table of Contents

Performance highlights

Performance highlights

Financial table

all amounts in millions of euros unless otherwise stated

| ||||||||||||

Sales | 26, | 23, | 25, | |||||||||

| ||||||||||||

EBITA1) | 1, | 2, | ||||||||||

as a % of sales | ||||||||||||

| ||||||||||||

EBIT1) | 54 | 2, | ||||||||||

as a % of sales | ||||||||||||

| ||||||||||||

Net income (loss) | (92 | ) | 1, | |||||||||

per common share in euros | ||||||||||||

- basic | ( | ) | ||||||||||

- diluted | ( | ) | ||||||||||

| ||||||||||||

Net operating capital1) | 14, | 12, | 12, | |||||||||

| ||||||||||||

Free cash flows1) | 1, | |||||||||||

| ||||||||||||

Shareholders&#; equity | 15, | 14, | 15, | |||||||||

| ||||||||||||

Employees at December 31 | , | , | , | |||||||||

| 1) | For a reconciliation to the most directly comparable GAAP measures, see chapter Reconciliation of non-GAAP information, of this Annual Report. | |

| 2) | For a definition of emerging and mature markets, see chapter 19, Definitions and abbreviations, of this Annual Report |

4 Annual Report

Table of Contents

Table of Contents

President&#;s message

President&#;s message

&#;We posted our best earnings margin in a decade, and retained our strong balance sheet.&#; Gerard Kleisterlee, President

&#; 25 billion | 10 | % | 59% | |||||

sales | EBITA as a% of sales | (co-) leadership Net Promoter Score | ||||||

Dear stakeholder

was a year in which you saw Philips rebounding strongly from the decline caused by the global financial crisis in Within the constraints of a much weaker economy we successfully implemented a major part of our Vision strategic plan, rounding out our transformation into a customer-focused, market-driven health and well-being company with a strong brand. We announced our new plan, Vision , setting out the roadmap to growth. And we posted our best earnings margin in a decade, while retaining a strong balance sheet supported by robust cash flows from operating activities.

However, economic recovery and consumer confidence remained fragile in , particularly in mature markets. Following a strong rebound in the first six months of the year, sales growth slowed in the second half, ending at 10% nominal for the full year. This growth was driven by all operating sectors, particularly Lighting, and our growing presence in emerging markets. On a comparable basis, sales were up % for the year.

We also recorded an EBITA margin of %, meeting our Vision target. I am especially pleased to report that this profitability improvement was driven by all our operating sectors, in particular Lighting, conclusively demonstrating the value of our portfolio. Our return on invested capital rose to %, compared to a cost of capital slightly in excess of 8%,putting us on the right path to achieve our Vision goals. And building upon that momentum, we continued to make strategically aligned acquisitions in each sector &#; no fewer than 11 in total.

During we also made good progress with the deployment of our EcoVision5 program. We brought care to the lives of some million people, improved the

6 Annual Report

Table of Contents

President&#;s Message

energy efficiency of our product portfolio by 4% and launched a series of programs to increase the recycled content of our products. After achieving our EcoVision4 Green Product sales target of 30% last year, we achieved our Green Innovation target in , two years ahead of schedule.

We are proposing to the upcoming General Meeting of Shareholders to increase this year&#;s dividend to EUR per common share, in cash or shares &#;resulting in a yield (as of December 31, ) of % for shareholders.

| 1) | Subject to approval by the Annual General Meeting of Shareholders |

How did we do against our Management Agenda ?

Drive performance

Drive top-line growth and market share

Sales amounted to EUR billion, or 10% nominal growth. Our % comparable sales growth was driven by a strong 9% increase at Lighting and growth of 4% at Healthcare, tempered by only 1% growth at Consumer Lifestyle due to weak consumer confidence in developed markets and ongoing portfolio pruning. Regionally, the US and Europe continued to face very challenging market conditions, though we were able to drive growth through emerging markets, which accounted for 33% of revenues, up from 30% in On average, market shares remained steady.

Continue to reduce costs and improve cost agility

We have finalized most of our organization transformation programs to optimize our industrial footprint and organizational effectiveness. As a result, productivity in improved by an impressive 20%. Our fixed cost reduction, as well as our focus on managing discretionary spend, contributed to our best EBITA performance since At the same time, we have continued to invest in Research and Development and increased our Advertising and Promotion spend in preparation for our Vision growth targets.

Further increase cash flow by managing cash aggressively

We generated EUR million more free cash flow than in , an increase to % of sales, on the back of higher cash earnings.

Accelerate change

Increase customer centricity by empowering local markets and customer-facing staff

We realized that we cannot truly empower local markets if our strategic and financial planning processes do not allow for a voice from the market and a granular, fact-based insight into the opportunities available in these markets. We therefore decided to apply a simple three-step approach where market opportunities precede financial planning. This involves explicit dialog on growth opportunities between market organizations and business groups, allocating funds to priority opportunities, and empowering market organizations to act within the overall framework without complex decision procedures. With this process in place, we should be better placed to capture the opportunities for profitable growth in our markets.

Increase number of businesses with NPS (co-) leadership positions

Outstanding customer and consumer loyalty is critical to achieving growth. In , our Consumer Lifestyle business increased its NPS leadership in a time of fragile consumer confidence in many markets. Healthcare maintained a strong position, and performed very well in China. Lighting noted a slight decrease, yet remains a clear leader in its industry, with 83% of leadership positions in The overall result is stable, with 59% of our businesses currently holding industry leadership positions, down one point from The result was negatively impacted by supply chain constraints during the year, and this will very much have our attention going forward. In line with our Vision growth targets, in we will continue to drive for further outright leadership in NPS in key markets.

Annual Report 7

Table of Contents

I am very pleased to say we made significant progress over the past year. Our overall Employee Engagement Index score reached 75%, up seven points from the previous year and one point above the worldwide high- performance benchmark. At 76%, our People Leadership Index improved by three points &#; clear evidence that our leaders are encouraging interaction and dialog. One of the most heartening aspects of this year&#;s results was that the biggest advances in our scores were in areas identified as needing improvement in the previous year&#;s survey. So our teams&#; hard work really paid off. Nevertheless, there are still parts of the organization where we have a lot of work to do, and our growth ambitions can only be realized if we continue to challenge ourselves.

Implement strategy

We have a strong presence in the emerging economies. We generate around one-third of our sales there, and aim to drive this figure up to at least 40% by To this end, we continue to invest in building our local organizations, competencies and resources in these markets.

In China, we made the first shipments from our industrial campus for imaging systems at Suzhou. Scheduled for completion in , this state-of-the-art facility expands our presence in China&#;s high-growth healthcare market with a complete portfolio that serves both the needs of the value segment as well as more advanced specialized applications.

We also moved the global headquarters of our Domestic Appliances business to Shanghai &#; building our business creation capabilities in this important market and taking a step toward making China a &#;home&#; market.

In , we entered into a full-cycle innovative partnership with Electron, Russia&#;s market leader in developing and manufacturing medical equipment.

We continued to invest in smaller, but strategically aligned and fast-growing businesses in In Healthcare, we made a series of acquisitions designed to strengthen our offering in clinical informatics, and in China we acquired ultrasound equipment manufacturer Shanghai Apex, enhancing our position in value-segment imaging solutions for emerging markets. Other acquisitions included Siesta&#;s Somnolyzer business, reinforcing our position in sleep diagnostics and OSA therapy in the strategic growth area of home healthcare.

We also unveiled our new Imaging platform, which is set to drive innovation and efficiency in radiology. Imaging is all about integration and collaboration &#; and new levels of patient focus that can help clinicians achieve what was unimaginable just a few short years ago.

In Consumer Lifestyle, we acquired Discus Holdings, the leading manufacturer of professional tooth-whitening products, complementing our existing Sonicare electric toothbrush portfolio and further building our relationship with dental professionals.

With regard to Television, we took further action to reduce our exposure, extending our brand licensing partnerships with Videocon (India) and TPV (China), which are both expected to contribute positively in

In Lighting we continued to drive the transition to LED, expanding our portfolio of LED-based solutions for both consumer and professional applications, with sales growing to 13% of sector revenues.

Value-adding acquisitions in included iconic Italian design luminaire brand Luceplan. We also acquired Burton, a leading provider of specialized lighting solutions for healthcare facilities, and Amplex&#;s street lighting controls activity, supporting growth of our outdoor lighting business. Toward the end of the year we bought NCW Holdings, a leading Chinese designer, manufacturer and distributor of LED and conventional entertainment lighting and lighting control solutions.

In we increased our Green Product sales to 38% of Group revenues (far ahead of our 30% target), with strong contributions from all sectors, Lighting in particular. We increased the energy efficiency of our operations by 6% and reduced our operational carbon footprint by 7% &#; on track to achieve our EcoVision4 reduction target for We also developed roadmaps to phase out PVC and BFR from new consumer products introduced onto the market in

8 Annual Report

Table of Contents

In September we announced our Vision strategic plan, which focuses on fuelling growth, increasing brand preference and strengthening our market leadership in the domain of health and well-being.

This new five-year plan builds upon the achievements of Vision Through Vision we transformed Philips into a health and well-being company with a stronger focus on emerging markets. We built a strong, balanced portfolio of businesses, simplified the company in order to capitalize upon market opportunities, invested in marketing and innovation to drive future growth, and structurally lowered our cost base, thereby boosting profitability.

Now we are ready for the next step &#; growth. We want to become the preferred health and well-being brand in most of our chosen markets, as we leverage major global trends to expand our leadership in key businesses such as home healthcare, LED lighting solutions and healthy living and personal care. We will also focus even more strongly on emerging markets &#; as the number of middle-class households in these markets rises, we expect demand for our products to increase as people have more money to spend on feeling and staying healthy. Last but not least, we remain committed to leading the way in the area of sustainability through the execution of our EcoVision5 program.

With our understanding of global trends and people&#;s needs and aspirations, as well as our strong brand, solid financial foundation and engaged workforce, I believe we will continue to simply make a difference to people&#;s lives with meaningful, sustainable innovations &#; and so deliver structural top-line growth and consistently healthy profit margins.

In concrete terms, we have set ourselves the following challenging, yet realistic medium-term goals for the period:

| &#; | Comparable sales growth on annual average basis at least 2 percentage points higher than real GDP growth | ||

| &#; | Reported EBITA margin between 10% and 13% of sales | ||

| &#; | Growth of EPS at double the rate of comparable annual sales growth | ||

| &#; | Return on invested capital at least 4 percentage points above weighted average cost of capital |

Our overall challenge for is to accelerate growth. This year we will take a series of firm steps towards implementing our longer-term Vision objectives. This will require us to accelerate our current course and performance in order to seize the great opportunities we have in most of our markets.

Under Drive performance we stress the need to urgently accelerate the pace of growth, to take market share and deliver on our financial and sustainability objectives.

Under Improve capabilities we outline what is required to grow faster: a customer-centric culture of growth, with granular business/market plans and the resources to realize them, enabled by pragmatic teamwork across the organization. If we succeed in bringing these elements together, we will deliver, with excellence and faster time-to-market.

The final column Implement strategy refers to the strategic battles we want to win and underscores how crucial it is to succeed in the rapidly growing emerging markets.

Upon approval by the Annual General Meeting of Shareholders, Frans van Houten will succeed me as President of Philips as of April 1, Frans knows Philips very well and brings strong qualities to the post &#; energy, strong leadership and a deep understanding of both professional and consumer markets. Under his leadership Philips&#; future is in very good hands.

I would like to take this opportunity to thank Pierre-Jean Sivignon for his valuable contribution to Philips in his six years as our CFO. He has been a great colleague and business partner to work with, and I wish him the very best for the future. I am delighted that in Ron Wirahadiraksa we have found a highly qualified successor from within our own ranks.

I would also like to express my deep gratitude to Jan-Michiel Hessels, who is stepping down as Chairman of our Supervisory Board, for his counsel and support during my tenure as President.

On a sadder note, toward the end of the year we lost a fine colleague with the passing of Gerard Ruizendaal, our Chief Strategy Officer. Gerard played a key role in defining the strategic focus of the company and in strengthening our business portfolio. He is deeply missed.

Annual Report 9

Table of Contents

It has been an honor to serve this great company as President and CEO. As I prepare to hand over the reins to my successor, I see a people-focused, market-driven Philips providing innovative, simplicity-led solutions to key global issues &#; the demand for affordable healthcare, the desire for personal well-being and the need for energy efficiency. I see a financially sound Philips with a strong brand and leading market positions, especially in emerging markets, as well as highly engaged employees. In short, I see a Philips that is in good shape &#; and ready to fulfill its ambition of becoming a global leader in health and well-being.

In conclusion, I would like to thank our customers and suppliers for their loyalty and support over the past ten years, and our employees for their unstinting dedication and efforts. I would particularly like to thank our shareholders for their continued endorsement of our strategic direction. In executing our Vision program, I know that Frans van Houten and his team will do everything within their power to maximize Philips&#; full potential and so grow the value of our shareholders&#; investment.

Gerard Kleisterlee, President

Accelerate growth to achieve Vision

Drive performance

| &#; | Make the turn to faster growth and gain market share | ||

| &#; | Deliver on financial returns | ||

| &#; | Deliver on our EcoVision sustainability commitments |

Improve capabilities

However, whether you choose to use their software or not, once you install the drivers on your operating system, OBS Studio and Streamlabs OBS or Xsplit can see the device and can immediately begin to leverage its benefits. ph3How to Use a Capture Card with Streamlabs OBS and OBS Studioh3pStreamlabs OBS and OBS Studio are the premier live streaming software packages currently used.

Its simple and easy to use; setting it up for use with a capture card is only a handful of steps.

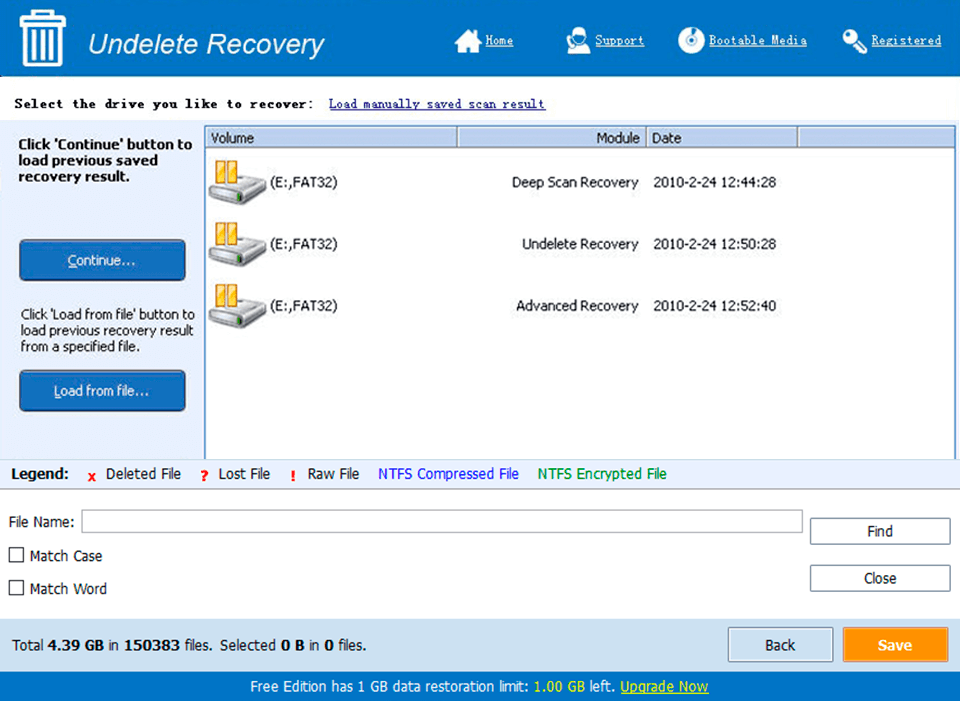

.What’s New in the 126 Pet Wide Area Network 5.1.8 serial key or number?

Screen Shot

System Requirements for 126 Pet Wide Area Network 5.1.8 serial key or number

- First, download the 126 Pet Wide Area Network 5.1.8 serial key or number

-

You can download its setup from given links: